The Consumer Financial Protection Bureau on Friday proposed a new measure that could protect your Robux from scammers and hackers.

The proposed rule interprets terms in the Electronic Funds Transfer Act, or EFTA, traditionally used to protect consumers from unauthorized debit transactions, to include certain virtual currencies offered by gaming and digital currency companies.

“Players — or in some cases their parents and guardians — have reported issues such as trouble converting dollars to in-game currency, unauthorized transactions, account hacking and hijacking, theft, fraud and loss of assets,” the CFPB post said. ” Their proposal also explained that they receive limited and no assistance from the game companies and banks or digital wallets involved. Refunds are often denied, people find their game accounts suspended by the video game company after a player tries to get a refund from their financial institution, or people run into problems with customer service representatives while they’re new. They are based on artificial intelligence. Trying to get straight answers.”

Friday’s suggestion is to solve these problems. EFTA protects consumers who transfer funds electronically, limits their liability for errors, and provides them with ways to correct illegal transactions. Upon notification by the consumer, covered financial institutions are required to investigate unauthorized transactions and promptly correct errors. In its proposed interpretation, the CFPB says that consumers have these rights when using certain virtual currencies.

However, EFTA is likely to only apply to games that allow players to exchange currency between themselves using accounts that look like “consumer asset accounts”. For example, the popular children’s game platform Roblox allows creators to earn Robux by selling cosmetic items or building their own in-game worlds and experiences. Robux can be converted to USD through the Roblox DevEx program.

Not all games that have in-game currency are necessarily subject to this rule. For example, Fortnite players can spend cash for V-Bucks to buy cosmetic items and “battle passes,” but the currency cannot be exchanged between players and other merchants.

Last year, the CFPB put gaming companies on notice and released a report detailing the risks involved in buying and transferring virtual currencies. In it, the agency argued that banks and virtual currencies on gaming and crypto platforms increasingly resemble traditional banking infrastructure, with few protections for users if funds are lost or stolen.

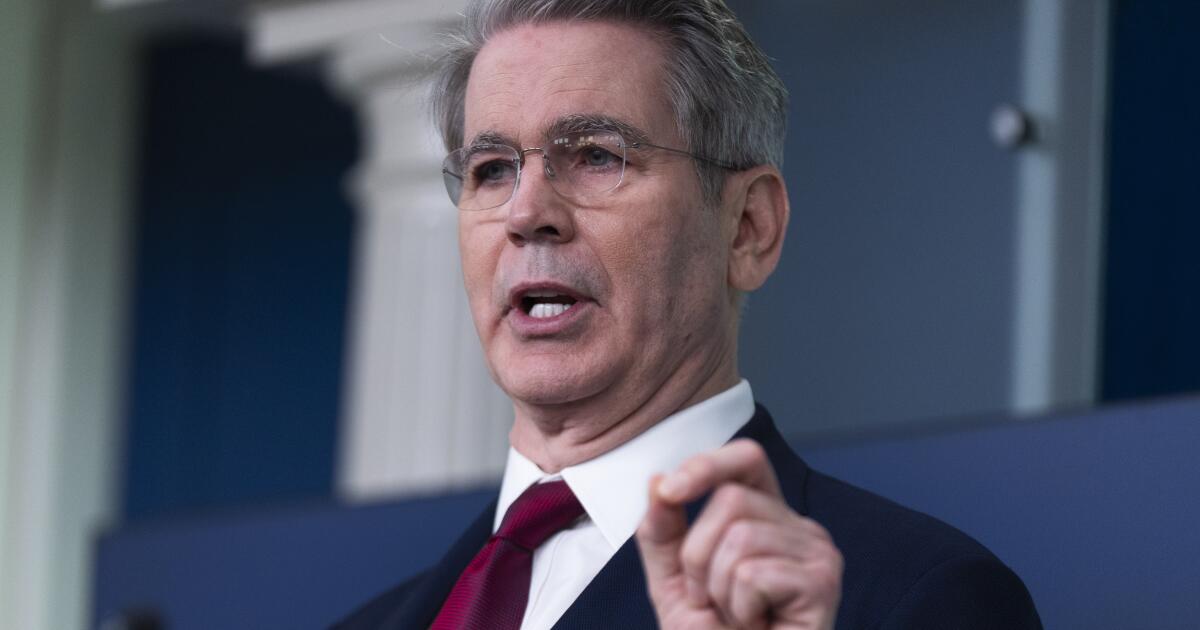

“Americans of all ages are converting billions of dollars into currencies used in virtual reality and gaming platforms,” CFPB Director Rohit Chopra said in a statement about the transactions last year. As more banking and payment activities take place in video games and virtual worlds, the CFPB is looking for ways to protect consumers from scams and fraud.

Despite facing numerous lawsuits and government investigations over the past few years, the video game industry has remained largely unregulated. Just last month, the Federal Trade Commission reached a settlement with Epic Games, the developer of Fortnite, requiring the company to return more than $245 million in refunds to users who were allegedly tricked into buying the game’s virtual currency.

The CFPB’s proposal likely won’t go into effect anytime soon. In a press release issued Friday, the agency said it will receive feedback, particularly from gamers, about the protections they need. The deadline for feedback is March 31, 2025.